Our Services

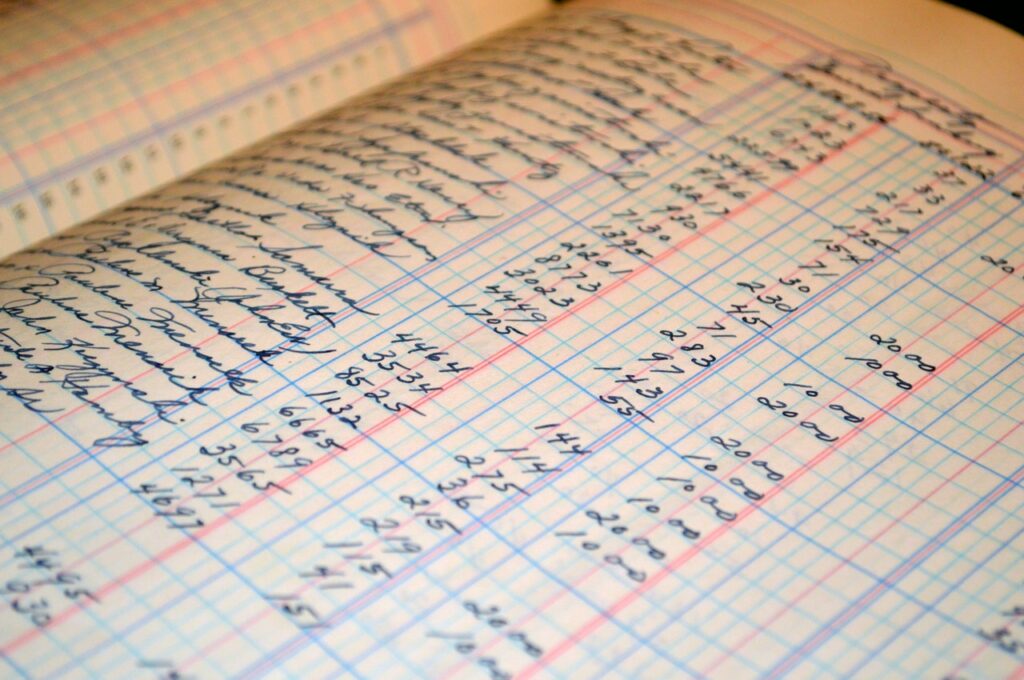

We manage several different responsibilities within a small business however, the main focus is the organisation, recording, and reporting of financial transactions as part of the operational life of a small business. Here are some of the services we offer to help keep your business running smoothly:

Payroll

Payroll can be a challenging task as your resources increases and the process becomes complicated. Therefore, seeking assistance from a professional at some point can be a good idea to save resourcing costs.

Accounts Payable

Tracking the outstanding invoices from your goods and service providers is sometimes a struggle, and paying them on time is vital to maintain good relations with your suppliers. We help you manage your cash flows as it can become complex for your business.

Accounts Receivable

Tired of chasing overdue invoices from your customers? We implement seamless processes for preparing and sending invoices by utilising modern tools and ensuring the funds are received in your account on time.

GST, BAS & Income Activity Statement

Getting the right amount of tax is essential for running your business free of trouble and maintaining the profits. Calculating the correct GST and controlling the Instalment Activity Statement is something our certified bookkeepers specialise in by keeping an eye on your collectables and correcting the GST you have paid on the purchases. Let us manage these effectively and effortlessly for you.

Tax Returns and Preparation

Paying less tax unethically can jeopardise your business, and paying too much can eventually result in a loss. Bookkeeping experts stay up-to-date with the industry's latest news and can offer various ways to prepare you for tax returns. Hiring a professional bookkeeper is a good strategy to prepare your tax bill.

Inventory

This service entails the cost of goods, tracking products, receive notifications when your stock is low, browse what's popular, create purchase orders, manage your vendors, import or sync your data with Amazon, Shopify, and more.

Financial Statements & Reporting

Balance sheets, cash flow reports, profit & loss reports, and reconciliation reports on a regular basis make crucial decisions in your business and your tax bill. Altogether, they demonstrate your business position. We specialise in such areas to minimise errors.

Why Choose Us?

If bookkeeping is complicated for you and taking a lot of your time that you can invest in your business, our professional bookkeepers can make a big difference.

- We help you simplify your business finances

- Better Tax Prediction: With knowledge and wisdom, we can estimate a precise outcome of your tax matters

- With advanced software and dedicated tools, we keep detailed records up-to-date which helps to analyse your business financial statements

- Our bookkeepers comply with legal rules and regulations to ensure your accounts are accurate and updated in the event of any changes

What You Get

Other than working with a focused bookkeeping firm, you are stress free of your books and can aim ahead to further develop your business along with:

- Lower your costs

- Instant Reporting

- Avoid tax penalties

- Organised business processes

- Precise budget for your business

- Rapid response time to your queries

- Reliable measure of your business performance

- Moreover, grow your learning in the process